Organisations regulating the trade in securities

Records of some financial organisations held at London Metropolitan Archives

London Metropolitan Archives holds the largest single collection of business archives held by a local authority in England and Wales representing businesses mainly based in the 'Square Mile' of the City of London as well as in the wider Greater London region. LMA’s holdings are especially strong in merchant banking and insurance, particularly in the period before the Big Bang, and in this accruing series, compiled by Claire Titley, we take a closer look at the records of business organisations which represented the interests of City professionals and firms or regulated them, such as the Institute of Chartered Accountants (ICAEW), the British Bankers Association (BBA), the Association of British Insurers (ABI), the London Stock Exchange (LSE) and the London Chamber of Commerce (the other LCC).

These records are relatively underused, and can be a valuable source of information on a wide variety of topics including the development of financial products and services, resourcing (finance/staffing/investment), the effects of technological changes (development of the office, new processes, new markets), employment (demographics, culture, commuting), the development of finance-related professions and the relationship between them, investment at home and abroad, the development of global markets and of financial services in other territories, the study of commodities, the relationship between the City of London with government, political parties and public opinion, and the relationship between organisations (including the role of the Bank of England), and finally, but not exhaustively, the changes to the physical nature of the Square Mile itself, its margins and the growth of areas such as Canary Wharf.

At LMA you can find books on the City around shelf mark 33.0 in the LMA Library. David Kynaston’s 'City of London – The History' is particularly helpful; it is rich on colourful examples and his interest in social history makes it a fascinating read. (It is an abridged version of his 4 volume history, which LMA does not have). More analytical is Ranald Michie’s 'The City of London – Continuity and Change 1850-1990'. There is a useful little series of books with titles such as 'What goes on in the City?' by Nicholas Ritchie (33.0 RIT). These were published every so often with updated definitions and are useful for basic descriptions (for example, a 1970s one will give you a very clear picture of the City at that period). LMA is better stocked with histories of individual banks, around the same shelf mark.

Of course, Guildhall Library has a rich collection of printed sources related to business history, and researchers intending to do any proper background reading should start there.

We continue by looking at records of organisations regulating the trade in securities and some of the bodies which represented those who issued them.

Records of some financial organisations held at LMA – regulating the trade in securities

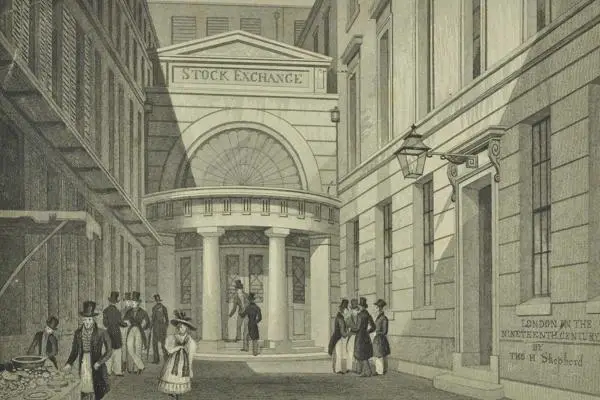

The London Stock Exchange

To alleviate its continuous shortage of cash, the Stuart dynasty issued loan tallies and tickets for future bill settlement. Dealers and tally-brokers carried on a market in these items, the value of which depended on the prospect of repayment, first at the Royal Exchange and then in the City coffee houses. Later, these dealers turned to the stocks of new commercial companies. In 1762, 150 substantial brokers attempted to take over Jonathan's Coffee House in Change Alley, Cornhill, for their exclusive use but, thwarted by a law suit, they moved, in 1773, into their own premises in Sweetings Alley, Threadneedle Street, at which time the name ‘Stock Exchange’ was formally adopted. A further move was made in 1802 into purpose-built accommodation on the corner of Throgmorton and Old Broad Streets. Further expansion on this site occurred, the premises being rebuilt in the 1880s and 1970s.

Until 1802, the Stock Exchange was open to anyone who paid the 6d a day subscription, but in March 1802 a deed of settlement formalised its constitution and the Exchange was closed to non-members. By its new constitution, a Board of Trustees and Managers (representing the owners) was established to regulate financial affairs and manage the building, while a General Purposes Committee was elected to regulate membership and all aspects of business. Sub-committees were appointed from amongst the members to undertake the detailed work. This arrangement lasted until 1946 when a reorganisation took place to solve the difficulties caused by the two separate bodies. The Stock Exchange became a members' society and the Council for the Stock Exchange assumed responsibility for every aspect of its government. Until 1986, the London Stock Exchange was unique amongst world exchanges in its distinction between dealing and broking. Dealers, or jobbers, offered stocks and shares for purchase or sale, and brokers acted as middlemen between them and the public, with the Settlement Department acting as a clearing house for all transactions. Rules and regulations to ensure fairness and eliminate fraud became numerous and complex. In cases of a member's financial failure, two members known as Official Assignees were appointed to administer the assets of the defaulter. In 1950, a Compensation Fund was established to provide further protection from losses caused directly by members.

What can the records be used for?

An excellent collection, not only giving a history of the institution itself, but also the markets for shares, commodities, foreign investments, its members, governance, defaulters, relationships with other institutions, its property and the development of the exchange. Most importantly, and their importance cannot be overstated, the applications for listing from companies that want to list on the exchange provide potted financial histories for thousands of companies, many of which have no surviving records.

See the Stock Exchange Research Guide for further details. Ranald Michie’s “History of the Stock Exchange” (available in the LMA Library at 33.6 MIC) is invaluable for queries that cannot be answered by the leaflet.

The records may be accessed via Guildhall Library. Printed sources, such as the Course of the Exchange and the Stock Exchange Yearbook, are also held at Guildhall Library

Find out more on the LMA online catalogue under reference CLC/B/004.

Corporation of Foreign Bondholders

The Corporation of Foreign Bondholders was entrusted by Parliament with the duty, amongst others, of watching over and protecting the rights and interests of holders of foreign government bonds and of making, for this purpose, representations to foreign governments. The Council of the Corporation consisted of 21 ordinary members, six of whom were appointed by the British Bankers' Association, six by the London Chamber of Commerce, and nine co-opted by the Council as a whole. The Corporation worked in close co-operation with independent bodies which dealt with particular countries or loans, such as the League Loans Committee (an international body), the Chinese Bondholders' Committee and the Committee of British Long-Term and Medium-Term Creditors of Germany.

What could these records be used for?

Invaluable for information about relationships with foreign powers (particularly interesting when loans go wrong) and changing trends in investment in foreign government bonds over time.

Find out more on the LMA online catalogue under reference CLC/B/060.

Issuing Houses Association

An Issuing House is an organisation, usually a merchant bank, which arranges the details of an issue of stocks or shares, and the necessary compliance with Stock Exchange. In 1944, representatives of constituents of the Accepting Houses Committee which acted as Issuing Houses in respect of foreign government and municipal loans, expressed dissatisfaction with their relationship with the Council of Foreign Bondholders which it felt did not consult them sufficiently. It was initially suggested that a sub-committee of the Accepting Houses Committee should be formed to represent the Issuing Houses of foreign bonds. However, in 1945, a separate association of Issuing Houses was formed; any institution involved in the field of issue or takeover activity might apply, with the exception of stockbrokers and foreign banks. Following the establishment of the City Code on Mergers and Take Overs, the Issuing Houses Association assisted in its administration; its members were required to observe the Code and accept its jurisdiction.

The Issuing Houses Association worked closely with the Accepting Houses Committee with which it shared premises and a small secretariat. In 1988, the Association's activities were merged with those of the Accepting Houses Committee resulting in the formation of the British Merchant Banking and Securities Houses Association.

What could these records be used for?

Invaluable for information about relationships with foreign powers and changing trends in investment in foreign securities. Also a mine of information about the relationship of its members with the government and financial establishment, as the association provided a forum for discussion of all the concerns of its members and a vehicle for putting the views of those members to the government, Bank of England and other authorities.

Find out more on the LMA online catalogue under reference CLC/B/127.

Accepting Houses Committee

An Accepting House is a firm or company, an important part of whose business consists of accepting bills of exchange. Following the outbreak of war in 1914, a large group of London merchant banks, heavily exposed to losses through customers in enemy countries not providing funds to meet acceptances when they fell due for payment, formed the Accepting Houses Committee. After the war, it continued as a loose knit body represented by a small executive committee which met irregularly to discuss matters of mutual concern. On the outbreak of war in 1939, Exchange Control regulations were brought into force, and much of the administration was entrusted to the banking community including Accepting Houses. Membership of the Committee at this time meant that the member was automatically an authorised dealer in foreign exchange, and the need for an Accepting House to be a member of the Committee was almost a necessity. After the war, the Committee became the forum of the City's most respected merchant banks. In 1988, its activities were merged with those of the Issuing Houses Association, with which it had shared premises and a small secretariat, resulting in the formation of the British Merchant Banking and Securities Houses Association.

What could these records be used for?

Key organisation for researching the City’s most significant merchant banks. Especially useful for information about relationships with foreign powers during the First and Second World Wars, and for banking and financial arrangements more generally during those periods.

Find out more on the LMA online catalogue under reference CLC/B/003.